A brief introduction to points

I can’t emphasize it enough: you don’t have to be rich to be a higher flyer! Sure, it helps to have disposable income for premium travel, but for the vast majority of us, myself included, those luxuries are simply too expensive to pay for with cash. The methods of The Higher Flyer heavily rely on secondary currencies instead; specifically, the reward points issued by airline, hotel, and bank loyalty programs. These points are the keys to unlocking a whole new world of travel that was previously exclusive to only the very wealthy.

To help explain the concepts presented on this page and the rest of this beginner’s guide, let’s consider a couple that has been saving for a summer vacation to South Africa. They’ve budgeted $4,000, and they’re savvy, thrifty consumers. They found decently priced airfares on a nice airline for roughly $1,100 per person.

This leaves them about $1,800. They search a number of hotels on online travel agencies like Expedia, but they ultimately decide to splurge for an Airbnb that’s located close to the city center. It costs about $126 per night, or around $1,100 for the entire time they stay in Johannesburg. It’s a good value, and it has a kitchen, so they can cook meals in lieu of eating out all the time.

With their accommodations set, the couple has roughly $700 to spend on activities, some meals out, and incidentals.

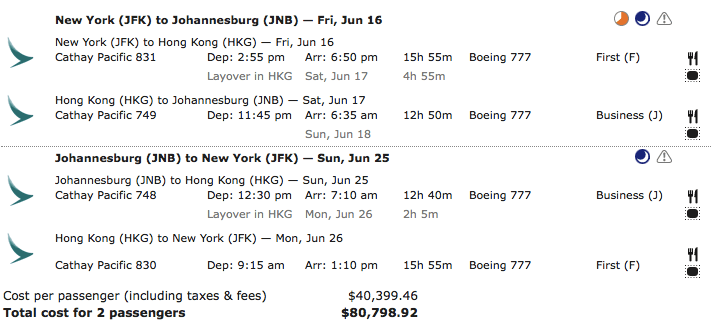

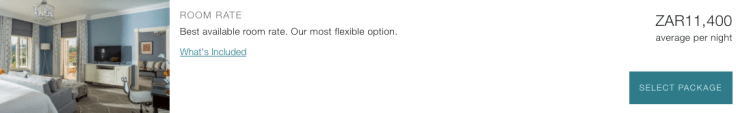

Alternatively, they can opt to “fly higher,” and fly first class on Cathay Pacific, one of the world’s premier airlines, and then stay at the Four Seasons, one of the finest hotels on the continent. Those options off-the-bat are a little bit pricier though…

However, they use the strategies I discuss in this guide and throughout The Higher Flyer. Because of the various frequent flier miles and other reward points they’ve accrued, they’re able to leverage them and redeem them for tremendous values. Instead of paying roughly $88,000 for this extravagant summer vacation, they’ll only spend about $250 total, and reward points will cover the rest. They’ll be left with an extra $3,750 to save away for something else.

Which would you rather pay: $4,000, or $88,000, or $250 and some reward points?

Loyalty Programs

In the contemporary marketplace, it seems everyone offers customers rewards and special perks. For example, a department store might send exclusive coupons to its newsletter’s subscribers, or a restaurant might give diners free side dishes after a few visits. Airlines and hotels and banks are no exception to this, and they’ve designed and implemented loyalty programs that are stupefyingly expansive. These entities enable higher flying; it’s important to be familiar with how they work. Their transaction models are simple in theory: in exchange for your business now, you’ll receive something valuable later, such as frequent flyer miles that can be redeemed for flights, and other perks like priority boarding. The same goes for hotels and banks. There is a perceived win-win for both the corporation and the consumer, as the latter is incentivized to remain loyal to a specific brand, and the former sees increased profits from consistent patronage.

In reality, the company wins a lot more often than the customer does. Even though frequent flyers might pour in tens of thousands of dollars for hundreds of thousands of travel miles individually, the perks they receive in exchange probably do not cost the airline very much. Sure, elite passengers will enjoy that free drink, or the extra three inches of legroom that come with the complimentary upgrade to Economy Plus, but it’s seldom a fair trade. Likewise for the frequent flyer miles they might be earning. They need to fly a lot to accrue enough for free travel, and as statistics prove, it’ll probably be for a short, domestic flight in cattle class (roughly 85% of redemptions fall in to this category), which comparatively isn’t costly either.

Compounding this issue of disparity are the strict regulations set in place by the companies. Trillions of miles, worth over several hundred billion dollars according to some analysts, remain unredeemed. I’ve heard far too many times from potential travelers that they don’t have enough miles, or there’s nothing compatible with their schedules, or organizing a reward flight is simply too complicated and not worth the hassle for them. That’s a shame, because the higher flyers who maximize the values of their points and perks can challenge the obstacles created by airlines and hotels and banks. They get to indulge in some pretty remarkable benefits that those same, seemingly restrictive, programs offer.

Points and Perks

In the context of the travel industry, companies offer two major types of rewards for loyalty: points and perks. Of those, there are some things that apply universally:

- Loyalty programs are privately self-regulated. There is no legislative body that governs how they work, so consumers are subject to the whims of the airlines/hotels/banks. You don’t have much leverage if the rules change, no matter how unfair such alterations might seem.

- Because so many of the different companies operate independently of one another, there are a lot of inconsistencies between various programs. For example, one United frequent flyer mile is generally worth more than an American or Delta mile when it comes to redemption values. Similarly, a perk might be offered by Delta, but not by American or United.

- The power of points and perks vary drastically depending on which airline/hotel/bank issues them, as well as how loyal you are to that one company. It should go without saying, but you’ll be entitled to a lot more on American Airlines if you fly hundreds of thousands of miles with them every year compared to someone who flies with them once a year.

Points

Points enable higher flying; without them, premium travel would be near impossible to afford exclusively with cash. When you start accruing reward points, it becomes much easier to leverage them, which is what you should do in order to accomplish what it is you aspire for in your travels. That being said, money and points must be considered as variants of the same thing: inherently valuable currencies. You should treat your miles with the same amount of care as you would your money.

Without going in to too much economic jargon, reward points are known as secondary currencies, and, believe it or not, they have a lot in common with dominant currencies like the Dollar and the Euro. There are three main functions of money, all of which are shared between the two currency types:

1) To serve as a medium of exchange (by facilitating financial transactions like buying and selling goods/services).

2) To be a store of value (by keeping its purchasing power over time).

3) To act as a unit of account (by tangibly measuring the values of goods/services).

Indeed, you can use both Dollars and frequent flyer miles to purchase an airfare (#1), even after some time has passed since you first earned those Dollars/miles (#2), and just as it might cost $300 to fly from New York to Los Angeles, it costs 12,500 American AAdvantage Miles to do the same thing (#3).

In my own experiences, I’ve found that it’s easiest to think of reward points as equivalents to cash rebates. A lot of stores and credit cards sometimes return money to a customer following a purchase. Airlines and hotels and banks offer the same thing, but instead of receiving cash back, you receive, say, Delta SkyMiles.

With all that being said, just as there are different kinds of currencies, there are three different kinds of points:

- Program Specific Points

- Fixed Value Points

- Flex Value Points

All of these variants can and should be used to fly higher, but not all of them are created equal. They differ in their spending powers, and depending on your situation and your travel goals, one might be more useful to you than the others. Below is a general summary of these…

Program Specific Points

Common Examples: American AAdvantage Miles, Marriott Reward Points

Program Specific Points are quite common. Pretty much every airline and hotel offers them as rebates to returning customers, and in turn, they can be accrued and then saved. When you pool enough points with a specific program, you can then redeem them for travel with that company and its partners, or maybe for some kind of perk or upgrade.

The downside to Program Specific Points is that they are privately regulated, and each issuing company has its own terms and conditions. To make the most of your redemption abilities, you have to be well-versed in a program’s fine print, which can be overwhelming at times. Furthermore, policy changes, like point devaluations, could be made at any moment without warning, which is not consumer friendly at all.

Fixed Value Points

Common Examples: Bank of America Worldpoints, Capital One No Hassle Rewards

The value of a single Fixed Value Point is pegged to a standard ratio, where one point usually equals one cent ($0.01). Unlike most Program Specific Points, Fixed Value Points are almost always exclusively issued by banks, and function quite similarly to cash. Redemptions are tied to cash prices, so a $100 travel expense would cost 10,000 points (using the standard ratio). When you do this, you are effectively buying an airfare/reserving a hotel room/renting a car/etc, and then trading points with the bank for a statement credit on your next bill. Because of this feature, you can usually earn Program Specific Points on this type of award ticket.

Fixed Value Points are great for domestic airfare redemptions, especially in Economy Class, as Program Specific Points aren’t as useful (typically). However, when it comes to international, premium travel, Fixed Value Points are not versatile. Take the $81,000 round trip flight on Cathay Pacific from above; that’d cost 8.1 million points. That’s not an impossible amount to accrue, but it’d take a long time to do so.

Flex Value Points

Common Examples: American Express Membership Rewards, Chase Ultimate Rewards

Flex Value Points are arguably the most useful currency type. Like Fixed Value Points, they’re issued by banks, but they are far more versatile. A Flex Value Point can be used either as a Fixed Value Point, or, it can be converted into a Program Specific Point. As an example, a Membership Rewards Point issued by American Express could be used to purchase any airfare at an exchange rate of 1 point to 1 cent (1pt = $0.01), or it could be transferred to a partner airline (or hotel), like Delta or Starwood, and then be used to redeem for a ticket. This basically gives point-holders the ability to choose the cheaper redemption rate, as well as protect them from things like devaluations. To refer back to the couple flying on Cathay Pacific to South Africa, they could spend 8.1 million Fixed Value Points, or convert a set number of Flex Value Points to Partner Specific Points with the desired airline and then redeem those. That would almost certainly be cheaper than 8.1 million points (It is).

As great as Flex Value Points are, they are harder to accrue than Program Specific and Fixed Value Points. Only a select few credit card companies offer them (American Express, Chase, and Citi), plus Starwood’s Preferred Guest Points can be considered them as well, so naturally there are fewer opportunities to earn them. On top of that, transfer partners are somewhat limited; you can only transfer to a program that worked out an agreement with the bank(s).

Flex Value Points are the most valuable of these three types because of their versatility, but you shouldn’t ignore the other two either. It’s important to diversify the types of points you collect…to an extent! The highest flyers have balances of all three points available to take care of any potential travel desire, but conversely, over-diversification can become a legitimate problem. Within each point classification, you should really only maintain balances with, at most, two or three programs. For instance, you can collect Program Specific Points with United Airlines and Alaska Airlines, Fixed Value Points with Barclay Bank, and Flex Value Points with American Express and Chase. That way, you have enough in each program to enhance your experiences, but not so many that you risk spreading yourself too thin and rendering your points ineffective.

Perks

Perks are generally straightforward and easy-to-understand. If you fly a certain amount of miles, sleep a specific number of nights in a hotel, meet a spending threshold, or achieve some combination of qualifications per year with a single company, you’ll unlock specific benefits that are provided by that business. There is a wide range of available privileges, spanning in value from a free drink to an upgrade to a premium seat. Each loyalty program has its own rules and regulations, and it’s important to be aware of them and the compromises you might have to make if you decide to be loyal to one brand.

Keep in mind that perks, compared to points, aren’t particularly powerful, and they typically only elevate higher flyers by a little bit. There’s always a chance that someone who holds elite status with a company might get an upgrade from economy class to first class, or might get moved from a base room to the presidential suite, but none of that is guaranteed, and it seldom occurs in practice. Perks are usually far less generous. Instead of going from economy to first class, a status-holder might receive complimentary access to exit row seating (in economy class) and expedited security.

Perks are not worthless though, as they frequently complement the experiences established by redemptions. Consider the couple traveling to South Africa, and let’s say they are both Executive Platinum members with American Airlines. Because they redeemed points for Cathay Pacific, a partner of American, they will fly first class. The perks afforded to them by American Airlines are reciprocated by Cathay Pacific, and as a result, they are allowed to check an extra bag and access the airport lounges, free of charge. These privileges are nice additions to the overall experience, but not much more than that.

By using the privileges offered by loyalty programs, like points and perks, anyone can become a higher flyer.

By now, you should have a theoretical understanding of how points and perks and loyalty programs work together to enable higher flying. Leveraging this trio creates opportunities that would otherwise be unaffordable for nearly everyone. Keep reading if you want to become a higher flyer, and then begin to accrue points on your own!